Stillwater's proposed fiscal year 2026 budget projects flat sales tax revenues while facing increased costs for utilities, according to a presentation delivered to the City Council Monday evening.

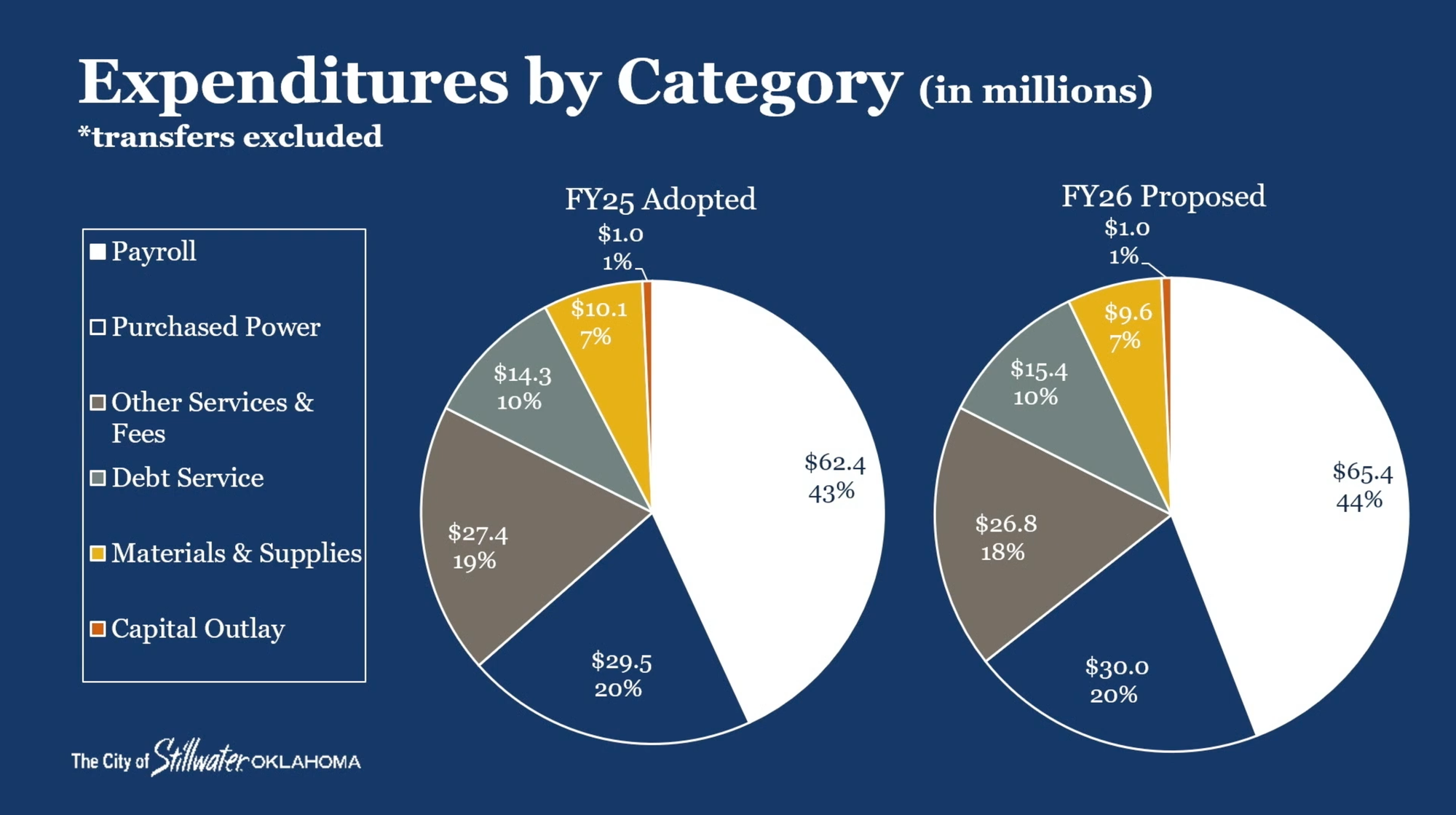

The $148.2 million expenditure budget maintains current service levels but includes higher costs for water treatment chemicals and pavement restoration related to water leak repairs.

Assistant City Manager and Finance Director Christy Cluck presented the budget proposal, highlighting that while utility sales revenues are projected to increase in line with scheduled rate increases approved in 2023, other revenue sources remain relatively flat.

"With the exception of the SUA funds, revenues are projected to be relatively flat," Cluck said during her presentation.

The budget includes a $2 million increase for electric sales revenue, a $2.7 million increase in water sales revenue, and a $200,000 increase in wastewater revenue, all related to the scheduled rate increases.

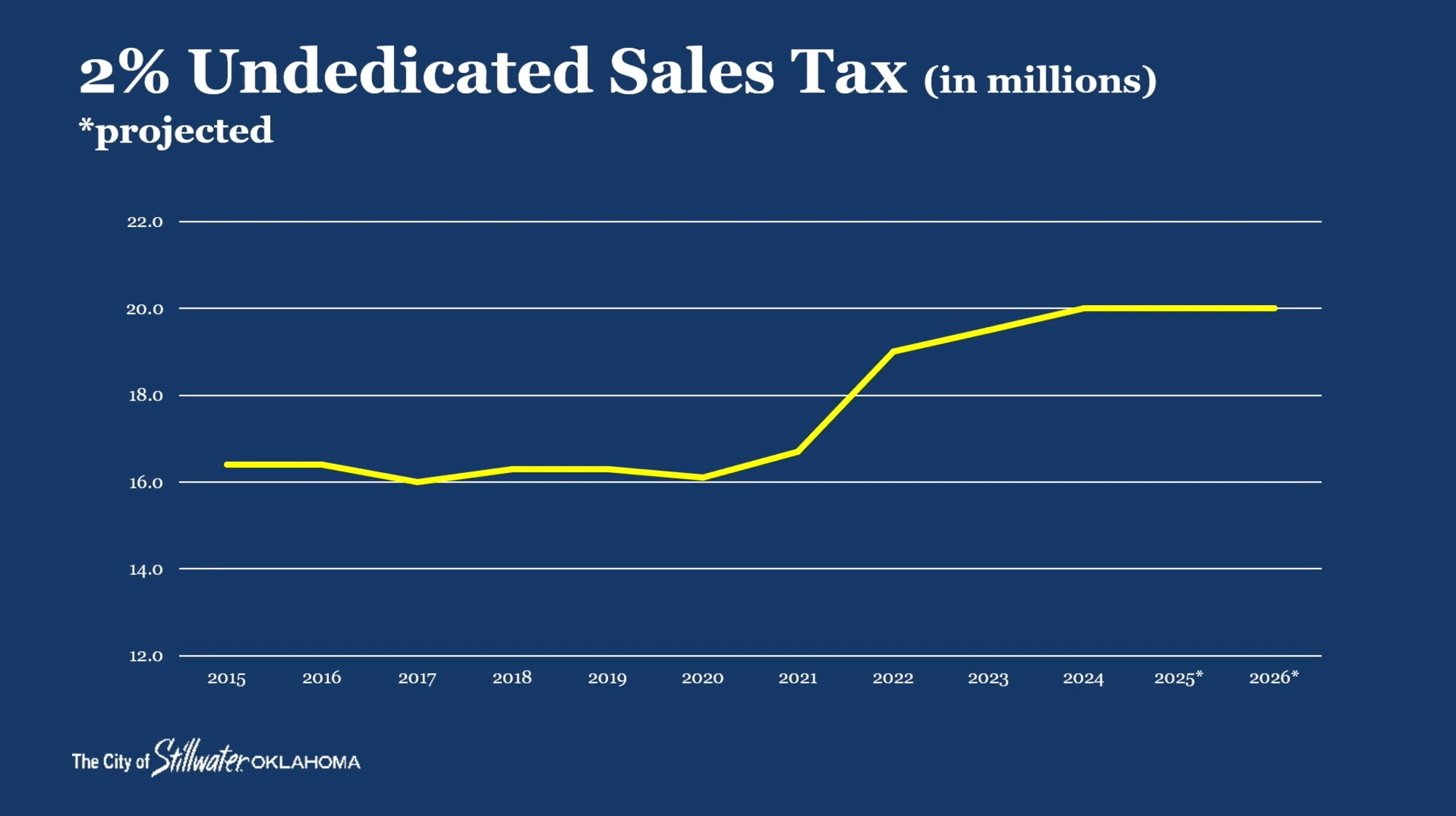

Cluck expressed concern about the leveling off of sales tax collections, which are the largest source of funding for the city's general fund.

"We saw significant increases in our collections beginning in 2021, most of which can be attributed to inflation and the increased cost of consumer goods. But our trend is now showing that those collections are levelling off," she said.

This trend is particularly concerning because sales tax is the primary funding source for general government services like public safety and parks.

The budget presentation revealed that public safety accounts for 22% ($32.7 million) of the total budget, exceeding the city's unrestricted general fund revenue of $28.5 million.

Mayor Will Joyce highlighted this discrepancy during the meeting.

"Just catching my eye from one slide to the other, $32.7 million spent on public safety, the next unrestricted general fund revenue is $28.5 million. Which means we don't make enough in our unrestricted general fund revenue to even cover public safety," Joyce said.

Cluck confirmed this assessment, noting that public safety takes up more than 100% of all general fund revenues.

The original home of Red Dirt Music is ready to boot scoot and boogie this April. Stillwater is filled with outdoor activities, live music festivals, art, and so much more this month!

Joyce emphasized that this situation is not unique to Stillwater.

"This is not something that's unique to Stillwater. It's not something that's unique, I think, in a lot of places. But I think it is important to note when we talk about using the other revenue outside of our general fund to add money to our expenses here, it's not because we're spending a lot of extra money on silly stuff," Joyce said.

To address this funding gap, the city relies on an annual transfer from the Stillwater Utilities Authority (SUA). For fiscal year 2026, that transfer amount is $23.7 million, up 8.7% from the transfer in fiscal year 2025 of $21.8 million.

The proposed budget also shows a negative $4.8 million in net income under the SUA operating fund.

"In order to cover that deficit, we are using the beginning fund balance to cover that," she said.

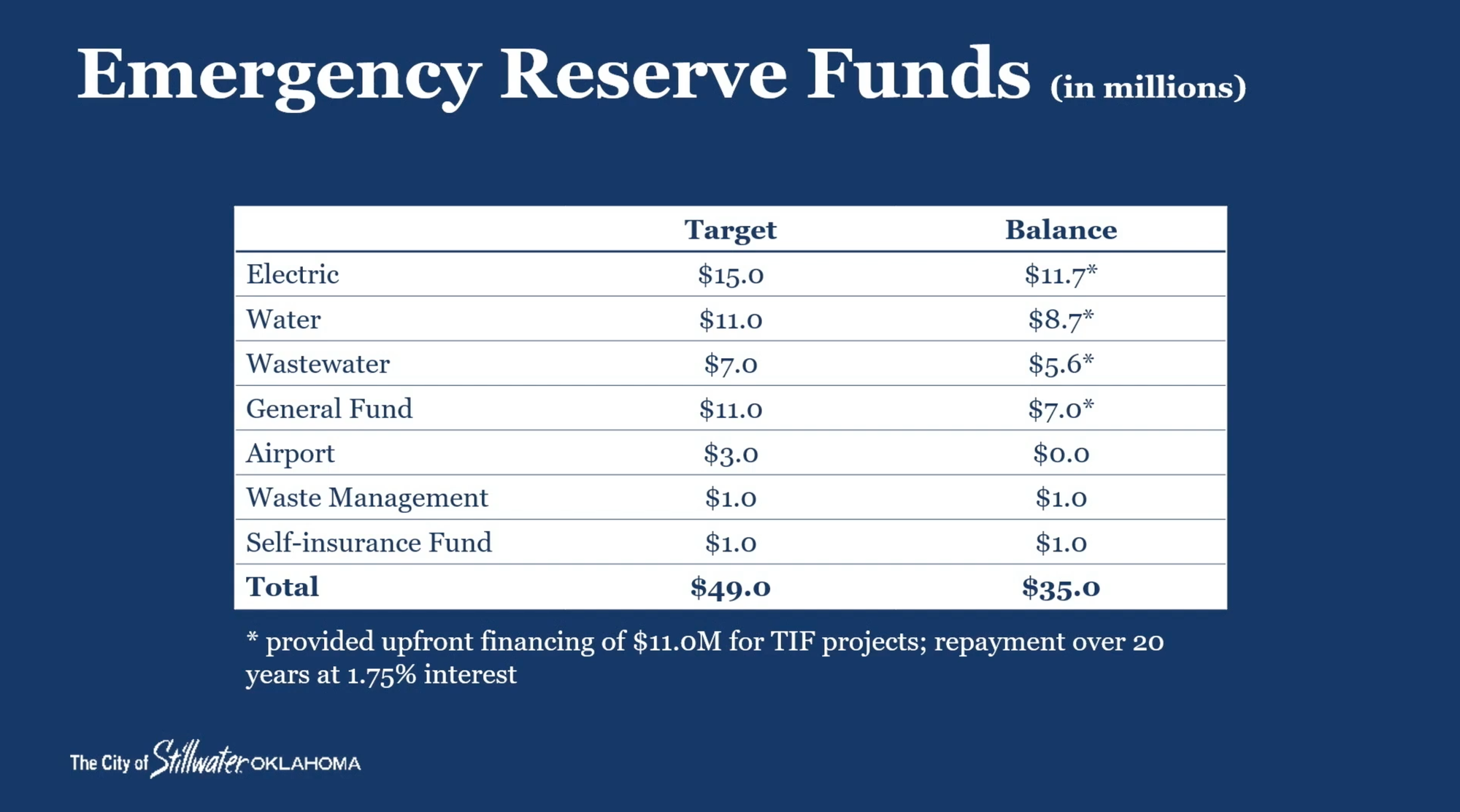

Despite these challenges, the budget ensures that emergency reserve balances remain in place. These reserves are established to meet the city's needs during extraordinary circumstances where unexpected loss of revenue or increases to expenditures occur.

The budget maintains consistent service levels compared to the current fiscal year. Major differences over the fiscal year 2025 budget include a $2.6 million increase in other governmental funds for health insurance increases, a $1 million increase in SUA funds for water treatment plant chemicals and the outsourcing of pavement restorations related to water leak repairs, and a $1.1 million increase in debt service payments spread across all funds.

"For functional areas with a dedicated funding source, so think of transportation, water and wastewater, capital expenditures will be brought to the council and trustees for appropriation once those contracts are ready to be awarded," Cluck explained.

For areas without a dedicated funding source, such as general fund departments, no capital is included in the proposed budget as there is currently no funding available.

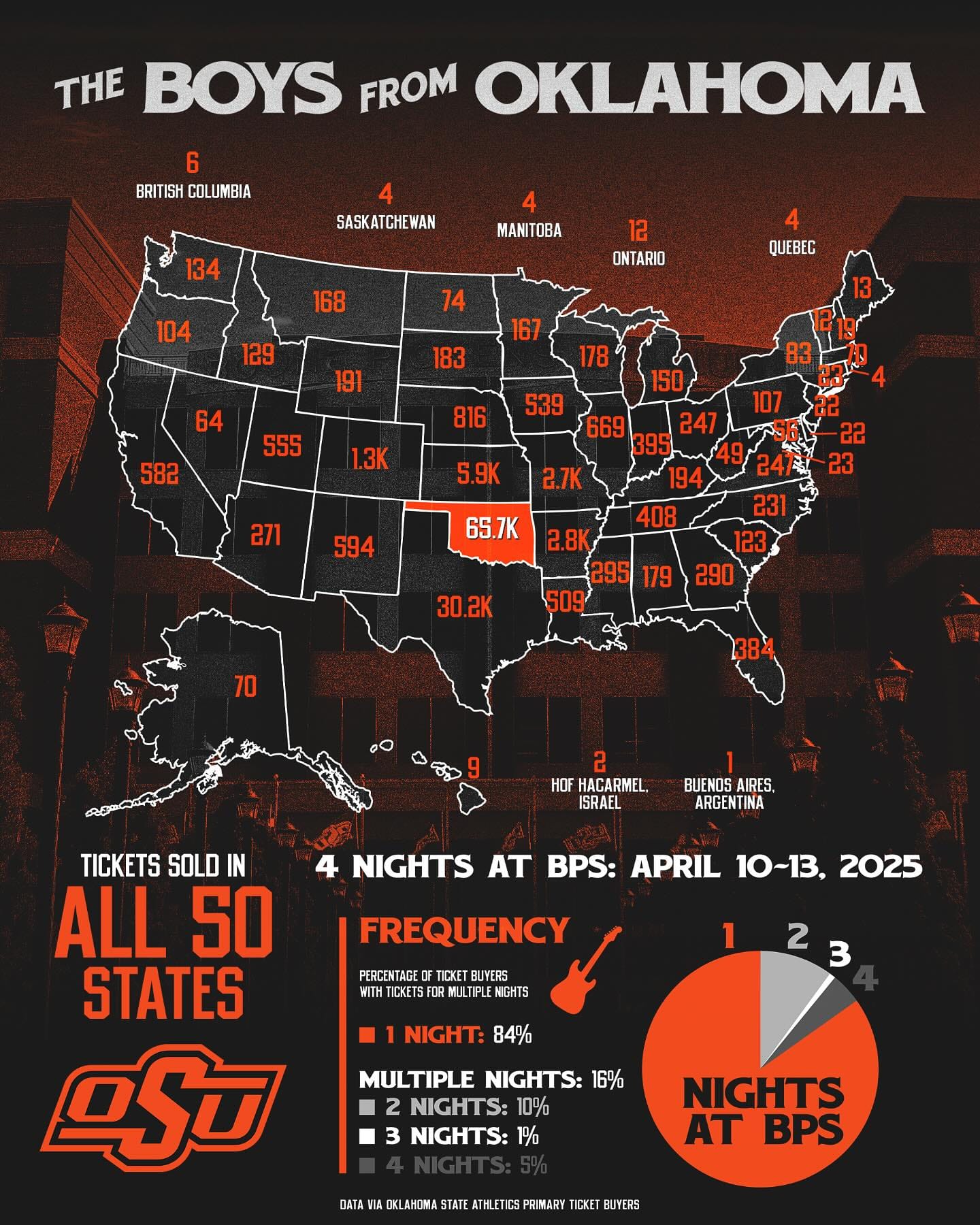

Cluck also noted that while events like the recent Boys from Oklahoma concert provide a boost to sales tax revenue, they should be viewed as one-time influxes of funds.

"Until those events become regular occurrence, they can really just be viewed and treated as just one time influxes of funds," Cluck said. "A better use of that is on one time capital expenditures."

Councilor Kevin Clark asked about the city's bond ratings, which had been a concern in previous years.

"We have made improvement in that area," Cluck responded. "There was a time when we were not moving forward with utility rate increases, even though we were experiencing increasing costs. That was putting pressure on our financial situation. Now that we do have the rate schedule in place and we are moving forward with that, that is alleviating that concern."

The budget presentation is part of the city's process to comply with the Oklahoma Municipal Budget Act. The next steps include a public hearing scheduled for May 19, followed by budget adoption on June 2, and the start of the fiscal year on July 1.